Oligopoly | A-Level Economics Notes

These revision notes cover everything you need to know about Oligopoly for A-Level Economics. They're designed for students studying AQA A-Level Economics, Edexcel A-Level Economics, and Edexcel International A-Level Economics. Written by Jaisul Naik, UCL Economics graduate and A-Level Economics tutor since 2017.

What is an oligopoly?

An oligopoly is a market structure dominated by a few firms.

What is collusion?

Collusion is when two or more firms agree to set high prices.

This is more likely to be possible if the two firms have a high market share and a similar market share.

After colluding, they act as a monopoly with their combined market share.

What is tacit collusion?

Tacit collusion is an informal agreement between firms to set higher prices.

What is overt collusion?

Overt collusion is an formal agreement between firms to set higher prices.

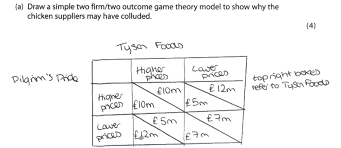

What are the reasons for collusive and non-collusive behaviour? use game theory

- If we assume that Pilgrim's Pride sets a high price, Tyson Foods would undercut them and set a low price.

- This allows them to make £12m profit.

- If Pilgrim's Pride expects Tyson Foods to set a low price, Pilgrim's Pride would match them as they don't want to lose market share or lose out on supernormal profit.

- As a result, lower prices are the most likely outcome in an oligopoly (Nash Equilibrium).

- Firms could agree to set high prices through tacit collusion. This requires trust but it would allow the firms to make £10m profit each.

- Collusion is unlikely to happen because firms are worried that:

- if one firm undercuts them, they lose a lot of their market share.

- if one firm snitches or the CMA finds out about collusion, the firms get fined heavily.

What are the outcomes in a collusive oligopoly?

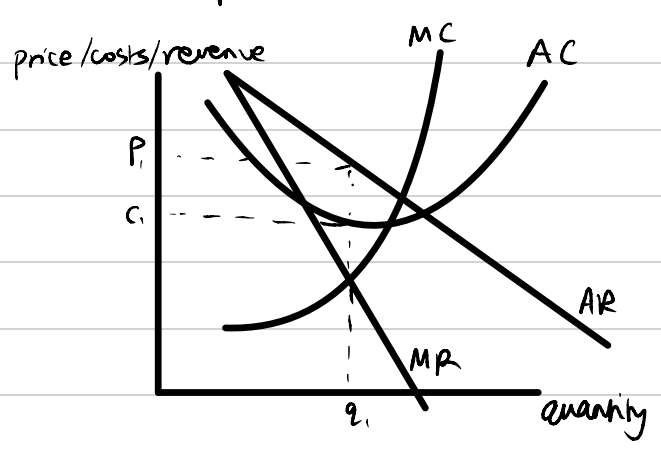

The outcome in a collusive oligopoly would similar to the outcome in a monopoly.

Monopolies are not allocatively efficient

- Firms maximise profits at the quantity where MC=MR

- Firms make supernormal profits.

- The price is high and the quantity is low.

- Firms are not achieving allocative efficiency.

- This is because MC does not equal AR and therefore

- the price is much higher than the marginal cost.

- Consumer surplus is much lower compared to the outcome in a competitive market.

Monopolies are not productively efficient

- Firms do not produce at the point where MC equals AC.

- Average costs are not minimised.

- Therefore, firms are not fully exploiting their economies of scale.

- Firms are not using all of their factors of production.

- If they were productively efficient, they would have been able to pass down lower prices to consumers.

Monopolies can be dynamically efficient

- Monopolies make supernormal profits in the long-run,

- which can be re-invested,

- leading to greater quality goods and services for customers over time,

- so greater consumer surplus.

- Although, firms may use supernormal profits to pay shareholders instead.

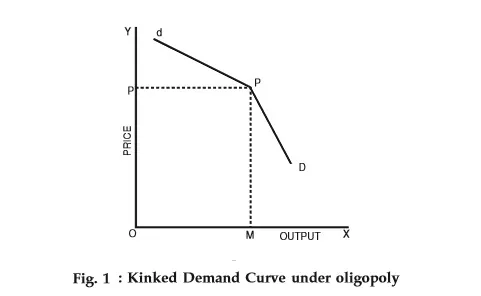

Draw and explain a model for a competitive oligopoly

The kinked demand curve shows the outcome in a competitive oligopoly.

- The kinked demand curve shows that firms in a competitive oligopoly stick to the price p1, and don't often change their prices.

- Firms in an oligopoly are interdependent.

- Firms would not reduce their prices from p1 because they would not gain much demand.

- Demand is inelastic at prices lower than p1.

- Firms would expect to gain more demand from lower prices

- but that does not happen because other firms would also lower their price

- due to fear of losing their market share.

- Firms would also not raise their prices from p1

- Demand is elastic at prices above p1.

- Firms would lose market share if they raised their prices,

- because customers would go to their competitors who kept their prices lower.

- If firms wanted to gain market share, they would use non-price competition

- Examples: brand loyalty (Nectar card), customer service, advertising, quality.

- Customers benefit from non-price competition as it rewards them for being loyal to one firm, and customers have various options e.g. each coffee shop has a different taste and stamps etc.

What are price wars?

- Price wars can start if firms try to lower prices to gain market share.

- This causes competitors to also match prices.

- For example, Aldi Price Match in supermarkets.

What is predatory pricing?

Predatory pricing occurs when a firm sells a good or service at a loss. Their aim is to force rivals to go out of business.

Most new entrants can't compete but a monopoly may have enough finance to sustain a loss. This causes other firms to leave the market and discourages new firms from entering.

Some firms like supermarkets may have loss leaders like cheap baked beans but they make a profit overall.

What is limit pricing?

Limit pricing happens when firms lower their prices to reduce their supernormal profit. This disincentivises new firms from entering the market.

Summary questions

- what is an oligopoly?

- what is collusion?

- what is tacit collusion?

- what is overt collusion?

- what are the reasons for collusive and non-collusive behaviour? use game theory

- what are the outcomes in a collusive oligopoly?

- what are the reasons for non-price competition? use the kinked demand curve

- what are price wars?

- what is predatory pricing?

- what is limit pricing?

A-Level Economics Tutoring

I offer one-to-one and small group A-Level Economics tutoring for students across the UK and internationally. With 87+ five-star Google reviews and tutoring experience since 2017, I specialise in helping students understand difficult concepts and improve their exam technique.